Gold CAGR in India over 5, 10 and 20 years

Gold has always been considered as the safest form of investment since ages. Particularly, in India gold holds a significant value both economically and culturally. Gold is considered auspicious in Indian culture and a favorite commodity to give a couple in their weddings. Indians are so enamored with gold that they like it to hold on for many years. Gold has given decent returns over the years especially during the time of economic uncertainty.

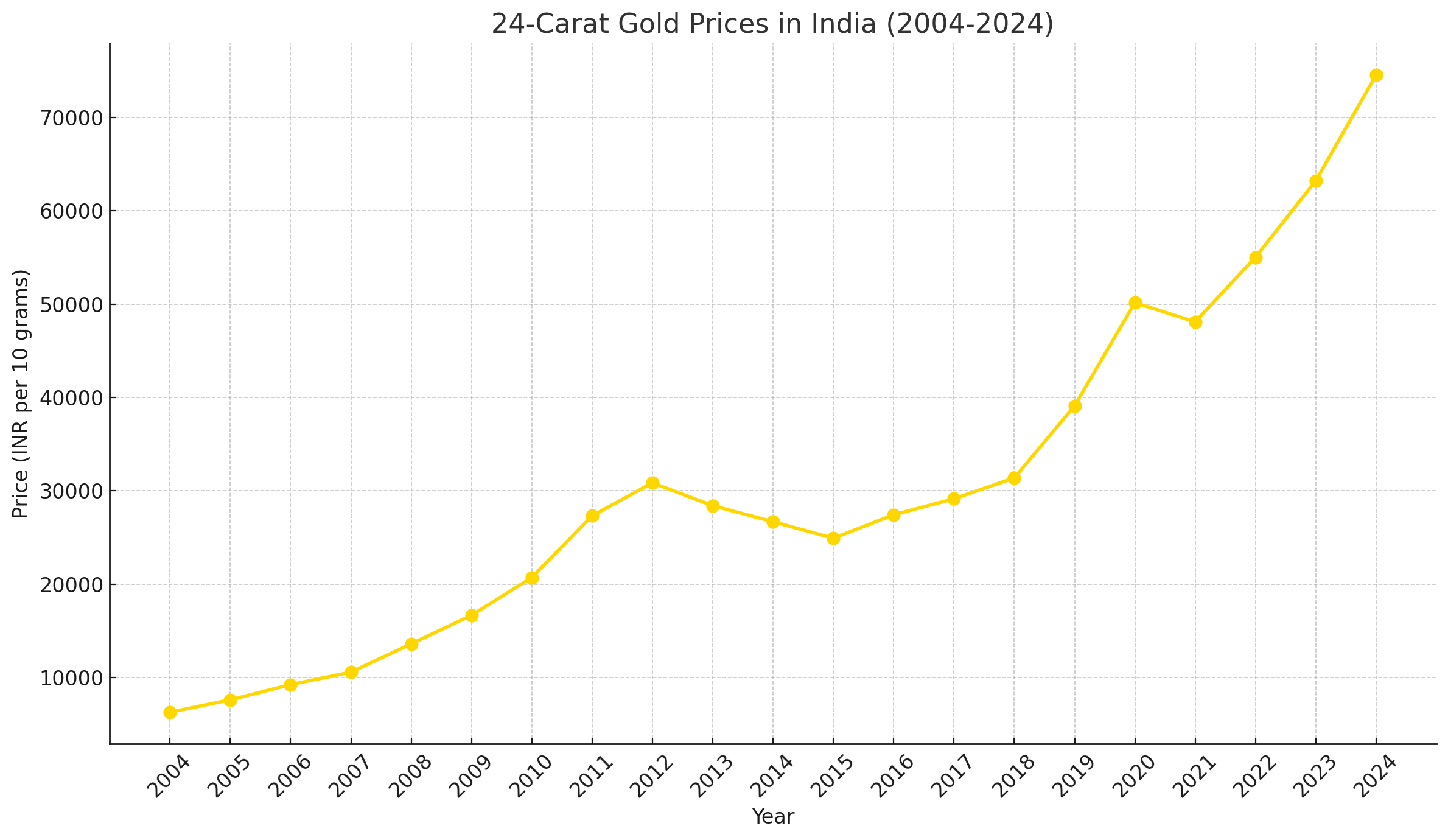

In this article, we are going to explore the compounded annual growth rate of gold ( CAGR ) in India over the last 5, 10, and 20 years and also compare it with the Nifty 50 index . We are also going to find out the price trend of gold over these years.

Not sure how to calculate the CAGR: Checkout our free CAGR calculator tool.

Price of gold in India varies from region to region because of state taxes and demand variations. In this article only the average cost of gold throughout India is taken into account. Here’s the latest price (as of October, 2024) :

Price of 24 Carat Gold: ₹7,961 per gram (₹79,610 per 10 grams)

Price of 22-Carat Gold: ₹7,292 per gram (₹72,920 per 10 grams)

Price of 18-Carat Gold: ₹5,971 per gram (₹59,710 per 10 grams)

See Also:The gold rate trend in india

5 Year CAGR of Gold :

In 2019, the 24K gold’s price was around ₹36000, which surged to ₹79610 in 2024. The CAGR of gold for this period stands at 17.2%, which is a far better return than many market indices amid covid-19 pandemic and economic uncertainty . This growth clearly shows investment in gold as safer and rewarding as well. During this period, the Nifty 50 index grew from 11000 ( October, 2019) to 24000 (October, 2024), for which the CAGR stands at 16.89%, which is still lower than Gold return.

10 Year CAGR of Gold :

Prices of gold have increased from ₹28,000 per 10 grams in 2014 to ₹79,610 in 2024. If we calculate the CAGR of gold over the past 10 years, it would come around 11.07% . During that period Nifty 50 index has gone up from 8000 (approximate value in october 2014) to 24000 ( as of now). The Nifty 50 index has given the CAGR return of 11.6%, which is quite close to the return given by gold. Gold and Nifty 50 stood neck to neck for this period.

20 Year CAGR of Gold :

Over the past 20 years the price of gold has increased substantially. In the year 2004 the price was merely ₹6000 per 10 gm but as of today i.e, in October 2014 the gold’s price has almost touched ₹80000 per 10 gm. The CAGR during this period stands at 13.8% and this period also witnessed the Year 2008 global crisis along with growing inflation. Despite all the macro economic and political events, gold remained as a safer mode of investment and the hedge against inflation. If we compare the gold’s return with Nifty 50 in India, the CAGR for Nifty 50 during this period was 14.8%. The Nifty 50 index has grown from 1500 in 2004 to 24000 in 2024.

Conclusion:

Gold has given a decent CAGR return over the last 5, 10 and 20 years. If you see the gold’s price chart above , despite a good return over these years, the year between 2013 and 2018 saw a negative return. So, it’s advisable to have a long perspective no matter how lucrative the investments sounds. An investor looking for a balanced portfolio can definitely add gold to their portfolio for protection against volatility in the market and earn good returns over the long run.

Disclaimer:

The article above should not be considered as investment advice. It is only written for educational purposes. The author of the article doesnot guarantee the accuracy of the data. Any investment comes with risk. Before making any financial decision, ask your financial advisor.

Disclaimer:

This website is provided "as is" without any representations or warranties, express or implied. The site provides CAGR (compound annual growth rate) value without any warranty for it's accuracy. All financial decisions should be made with consultation with your financial advisor. This website is not responsible for, and expressly disclaims all liability for, damages of any kind arising out of use, reference to, or reliance on any information contained within the site. By using this website you agree to those terms, if not then do not use this website.